Eon Patient Management

Identify Incidentals.

Ensure Follow-Up.

Designed for those who dare to defy disease and revolutionize healthcare, Eon is by far the most powerful solution to identify and manage patients with incidental findings. Using superior Computational Linguistics (CL) models, Eon captures incidental findings with up to 98.3% accuracy and 98.1% precision. Eon Patient Management (EPM) tracks and predicts patient follow-up, and arms providers with intelligence that saves lives and increases new hospital revenue.

Increase EBITDA

with the only advanced end-to-end platform that identifies and tracks downstream patient follow-up for all incidental findings.

Don’t Miss Another Incidental

with the most accurate Computational Linguistics solution to achieve higher true positive capture, with fewer false negatives.

Capture More Patients

using predictive analytics to prevent leakage and drive downstream patient care and revenue.

Diagnose Disease Earlier

by finding and tracking patients who need serial surveillance or immediate follow-up.

Optimize FTEs

with technology that offloads labor-intensive tasks, increases efficiency, and focuses attention on high-risk patients.

Reduce Administrative Burden

with best-in-class patient management and ensure no patient falls through the cracks.

Increase EBITDA

Capturing incidental findings is the #1 way to boost EBITDA.

“With Eon, we found a partner that allowed us to leverage cutting edge technology to improve patient care, drive operational efficiency and increase revenue while allowing us to standardize Incidental Findings across multiple disease states.”

Accelerate EBITDA with the most advanced Incidental Findings platform. Hospitals across the nation struggle and operate with thin margins. Volumes are down and they are losing millions of dollars a day, with EBITDA decreasing more than 13% year-over-year. A proven way to contest the trend and decrease patient leakage is to embrace a powerful platform that captures all incidental findings.

Capture More Patients

Prevent leakage and jump start service lines.

“Within just one week, we came across more than 10 patients who are now scheduled and may have been missed if not for Eon.”

Ramp up service lines by closing the gap on patient leakage. Healthcare organizations bleed revenue when they lose patients to out-migration. These missed opportunities and inefficiencies cost hospitals more than 10% of their overall revenue and have detrimental effects on patients facing catastrophic disease. Close the gap with EPM by predicting and preventing leakage before it happens.

Healthcare Executives:

87%

say leakage is a priority

20%

don’t understand where and why leakage occurs

Lost $ Because of Leakage:

40%

losing >10% of annual revenue

19%

losing >20% of revenue

Optimize FTEs

Focus on outstanding patient care and revenue-driving efforts.

“As an Eon client, my workflow improved so much I could manage patients in less than three minutes. Now I’m with Eon Care Management, helping empower new clients to improve efficiencies, increase patient adherence, and help catch early-stage disease across the entire country.”

Elevate Your Program with EPM. Building a successful incidental findings program can be challenging. With EPM’s automated data entry and comprehensive toolkit, you have access to an extensive resource library and time-saving tools. This empowers FTEs to prioritize revenue-gaining tasks, ensure adherence, and submit to the registries with one click.

Eon Care Management (CM). With Eon’s CM solution, you can offload resource-intensive tasks and focus your efforts on patient care and profit-earning. From mailing letters, to ensuring life-saving exams are scheduled, to following up with referring providers, to deactivating patients appropriately, Eon does all the work for you with a team of highly skilled navigators and clinical experts. This sets your program up for success and allows you to concentrate on growing your bottom line.

Don’t Miss Another Incidental

No other company can claim up to 98.3% accuracy for incidental findings capture.

“As an Interventional Pulmonologist focused on Lung Cancer, I have seen too much suffering from catastrophic disease. What gets me out of bed in the morning is knowing Eon moves fast to identify more disease and save more lives.”

Power Precision with Superior Data Science Models. Not all incidental registration techniques are the same. Eon’s CL—a proprietary data science identification model—empowers clients to positively identify and track incidental findings with unequalled precision. Natural Language Processing (NLP) and Computer Aided Detection (CAD) are other forms of Artificial Intelligence (AI), but are inferior techniques as their accuracy and precision are much lower and are disruptive to clinician workflow.

What is Computational Linguistics (CL)? CL is a data science discipline, or a subset of AI, that understands text and the linguistic structure of written English. CL achieves high-precision output with high positive predictive value that limits the number of false positives.

Diagnose Disease Earlier

You can’t diagnose what you don’t know about.

“I have no doubt that Eon Patient Management Software will change the landscape for patients with pancreatic cysts and tumors and have a true impact on survival from pancreatic-related diseases.”

Know More. Intervene Earlier. The most effective way to reduce disease mortality is by early diagnosis, yet most patients are asymptomatic until their disease has spread. That’s why capturing and tracking incidental findings, as well as your screening population, is so important. With best-in-class technology, EPM ensures longitudinal tracking of all patients, allowing providers to intervene and diagnose at-risk patients earlier, when treatment is most effective.

40%

of non-small cell lung cancer patients

are diagnosed with lung cancer when they are in stage IV.

82%

of pancreatic cancer

patients present with an advanced disease state.

Reduce Administrative Burden

Increase FTE efficiency and save time with EPM.

“This software is amazing! Eon is very user friendly and in just a few days has made our lives so much easier, especially being able to take away all of the manual work!”

Drive Efficiencies and Simplify Workflow. EPM is an intuitive solution that effortlessly navigates patients from identification to diagnosis, and seamlessly integrates with any hospital IT infrastructure.

- Automate redundant and repetitive tasks for the 80–90% of patients who are lower risk and need serial surveillance.

- Prioritize the 10–20% of high-risk patients who need immediate diagnostic workup and care coordination.

- Capture pertinent patient information like nodule characterization, size, location, and more, in one dashboard.

- Reduce manual data entry and administrative burdens for coordinators, navigators, and service lines.

- Offload resource-intensive tasks and focus on revenue-generating patient care.

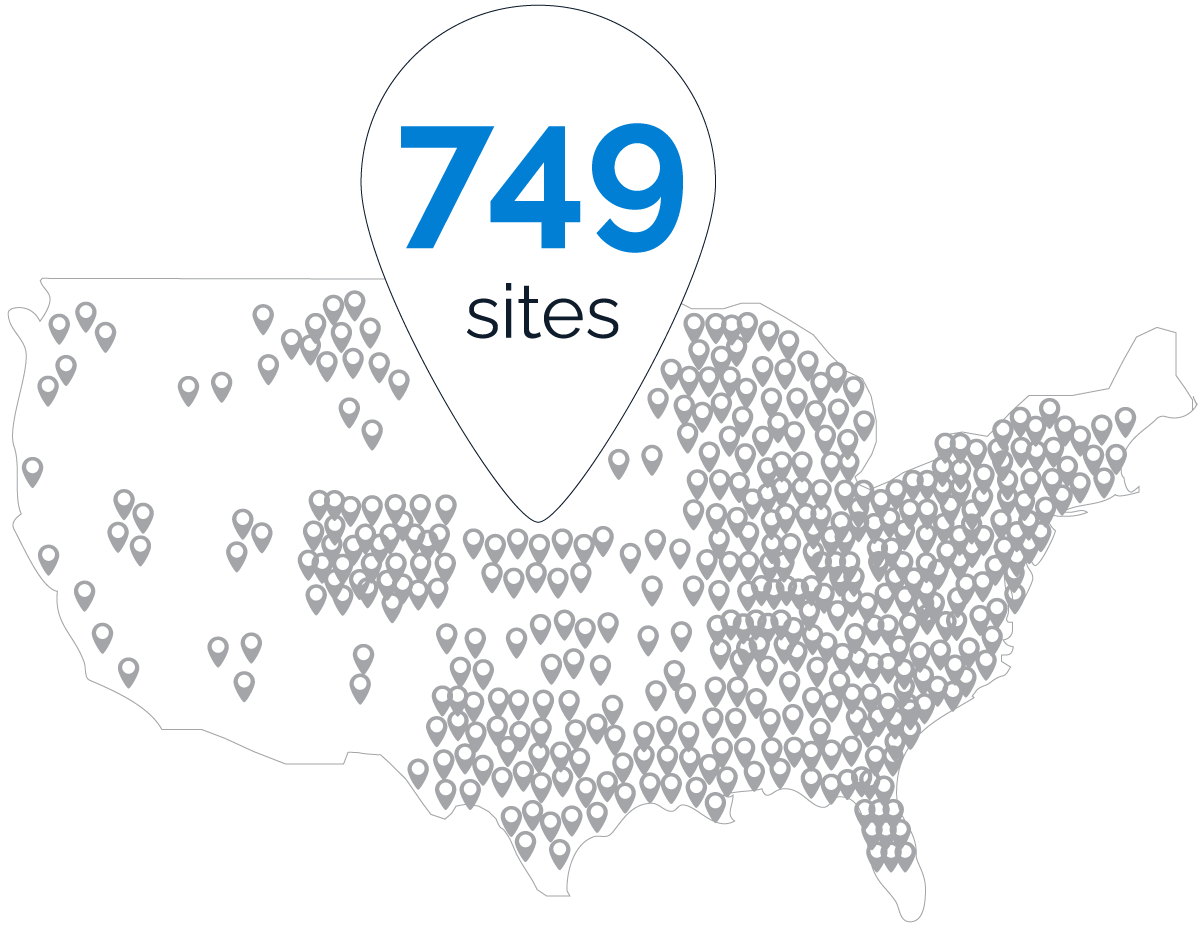

The United States of Eon

EPM is used by the nation’s most advanced & demanding healthcare providers.

Eon is proud to be a preferred partner of these established leaders in modern medicine:

Healthcare for you, by you. Eon was founded by renowned Interventional Pulmonologist Dr. Aki Alzubaidi, who was determined to create sea change in complex patient management. He saw too many patients suffer as a result of the broken, antiquated healthcare system—so he decided to solve the problem himself. Dr. Aki teamed up with clinical and data science experts to take on modern medicine and use advanced technology to revolutionize the way healthcare data is used to defy disease. Today, Eon is a market leader in improving patient care while lowering costs for providers across the country.

The Eon Advantage, Explained.

Investor Mark Cuban outlines Eon’s competitive edge.

Mark Cuban

Eon Investor and Advisor

“So, first of all, Eon stops siloing data. Instead, Eon gives outcomes. And because they’re able to be predictive, you’re able to be proactive.

Look, if the technology is sh*t, it’s not going to give you the outcomes that you’re hoping for. The beauty of Eon data is that you’re tracking outcomes. That’s the big difference from the old school programming that is all logic-based and doesn’t work—if this, then that.

That’s what differentiates. Logic-based is completely different from what Eon AI and its derivatives are doing.”

Mark Cuban

The Eon Edge

Access resources and expert content that can help you take your facility to the next level.

Ready to identify, track, and improve outcomes for patients at risk for future disease? Get started with your demo and ensure no patient falls through the cracks.